Electing S Corporation (S-Corp) status can provide significant tax benefits for small business owners, but timing is everything. If you missed the deadline to file your S-Corp election (Form 2553), you may still qualify for a Late S-Corp Election under IRS guidelines. However, failing to make the election properly can lead to higher tax liabilities, penalties, and administrative headaches.

In this guide, we’ll explain what an S-Corp election is, who qualifies for late election relief, the filing process, and why consulting a tax professional is crucial to avoid IRS issues.

What Is an S-Corp Election?

An S-Corp election is a tax designation that allows a business to be taxed as a pass-through entity, meaning profits and losses flow through to the owners’ personal tax returns instead of being taxed at the corporate level.

Key Benefits of S-Corp Status:

✅ Avoids double taxation (corporate + personal tax).

✅ Reduces self-employment taxes by splitting income between salary and distributions.

✅ Enhances business credibility with lenders and investors.

To elect S-Corp status, a business must file IRS Form 2553 within 75 days of the start of the tax year you intended to make the election for (typically by March 15 for calendar-year businesses). If this deadline is missed, businesses may need to file a Late S-Corp Election.

Who Qualifies to File a Late S-Corp Election?

The IRS provides relief for late elections under Revenue Procedure 2013-30, allowing businesses to file an S-Corp election retroactively if they meet the following criteria:

✅ The entity was eligible to elect S-Corp status on the effective date.

✅ The entity intended to be an S-Corp (e.g., operated as one, paid owners via payroll).

✅ The entity filed a tax return consistent with S-Corp treatment (e.g., reported pass-through income).

✅ The failure to file Form 2553 on time was due to reasonable cause.

Example of a Qualifying Late Election:

A business was formed as an Schedule-C and began operating in January 2024 with the intention of being taxed as an S-Corp. However, the owner missed the March 15 deadline but has been operating the business taxes as if it were an S-Corp. The IRS may allow a retroactive election if the business can prove its intention to elect S-Corp status.

S-Corp Election Requirements: Extra Work Involved

Electing S-Corp status comes with additional record-keeping and compliance responsibilities, including:

Required S-Corp Formalities:

- Payroll Compliance: Owners must be paid a reasonable salary before taking distributions.

- Corporate Meetings: Annual board meetings and shareholder meetings may be required.

- Equity Tracking: Distributions must be proportional to ownership percentages.

- Separate Business Finances: S-Corps must maintain separate bank accounts and financial records.

These additional reporting and compliance measures make good bookkeeping essential for S-Corp businesses.

When a Late S-Corp Election Is Advantageous

A late S-Corp election can be highly beneficial for businesses that:

✅ Have significant net profits and want to reduce self-employment taxes.

✅ Already operate like an S-Corp (paying payroll, issuing K-1s).

✅ Want to avoid double taxation while maintaining corporate liability protection.

Related Reading: For more details on when to become an S-Corp, check out our full guide on When to Elect S-Corp Status.

How to File a Late S-Corp Election (Step-by-Step Guide)

If you missed the S-Corp election deadline, follow these steps to file a late election under Rev. Proc. 2013-30:

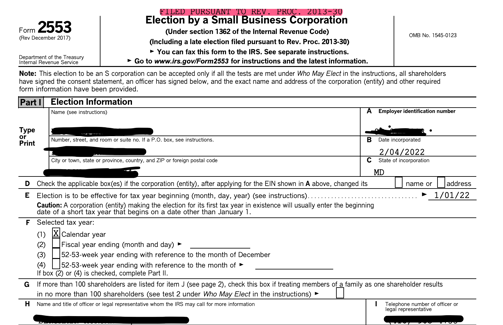

Step 1: Complete Form 2553 (Election by a Small Business Corporation)

- Fill out IRS Form 2553 as if it were being filed on time (include the intended effective date).

Step 2: Attach a Late Election Statement

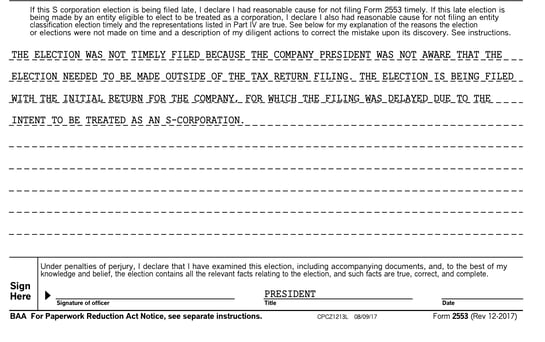

Important: At the top of Form 2553, write:

“FILED PURSUANT TO REV PROC 2013-30”

Attach a statement explaining why the election was filed late and confirming:

- The business always intended to be an S-Corp.

- The failure to file was due to reasonable cause.

- The business has consistently reported income as an S-Corp.

Step 3: Submit the Election to the IRS

- Fax Form 2553 to the IRS (recommended) OR

- Mail Form 2553 to the appropriate IRS address (delays possible).

- We don’t recommend mailing as it doesn’t offer the same proof of receipt from the IRS as faxing.

Step 4: Wait for IRS Confirmation

You will receive a letter in the mail either approving or denying your application. Be sure to keep this for your records (forever) and provide a copy to your tax preparer.

- If approved, the S-Corp election is retroactively effective from the original intended date.

For more details and the latest IRS guidelines, visit the IRS website.

Penalties & Issues from Not Filing an S-Corp Election

Failing to properly elect S-Corp status can result in significant financial consequences:

Tax Consequences:

- The business may be taxed as a C-Corp or default LLC, leading to higher tax rates.

- Self-employment taxes may apply to all business profits, increasing tax liability.

IRS Penalties:

- The IRS may reject pass-through treatment, forcing the business to amend previous returns.

- Interest and penalties may be assessed on improperly reported income.

Why You Should Consult a Tax Expert Before Filing

Filing a Late S-Corp Election can be complex, and mistakes can lead to IRS rejections, penalties, or tax audits. A qualified tax professional can help:

✅ Determine eligibility for a late election.

✅ Ensure proper documentation to avoid IRS rejection.

✅ Set up payroll compliance to meet S-Corp requirements.

At LedgerFi, we specialize in S-Corp elections, late election filings, and business tax strategy.

Need help filing your Late S-Corp Election? Contact LedgerFi today to ensure your business gets the maximum tax benefits while staying IRS-compliant.

Final Thoughts: Don’t Miss Out on S-Corp Tax Savings

If your business intended to elect S-Corp status but missed the deadline, you may still qualify for a Late S-Corp Election under Rev. Proc. 2013-30. Taking the right steps to file Form 2553 correctly can help you reduce self-employment taxes and ensure IRS compliance.

Key Takeaways:

✅ Missed the deadline? You may still qualify for late election relief.

✅ Ensure compliance with S-Corp payroll, distributions, and tax filing rules.

✅ File Form 2553 with a late election statement to request retroactive approval.

✅ Work with a tax professional to avoid IRS issues and maximize benefits.

Need expert guidance? Let LedgerFi help you file a Late S-Corp Election the right way! Schedule a consultation today.