Nonprofits operate under different financial rules than for-profit businesses, requiring specialized bookkeeping and accounting to ensure compliance, transparency, and sustainability. Accurate accounting helps nonprofits maintain their 501(c)(3) tax-exempt status, secure funding, and provide detailed reporting to donors and regulatory agencies.

However, many nonprofits struggle with proper financial management, leading to IRS scrutiny, loss of funding, or operational inefficiencies. In fact, according to the IRS, roughly 1%–2% of nonprofits are audited each year, with larger organizations facing higher audit risks. Avoiding common pitfalls and leveraging accounting best practices can ensure that nonprofits remain compliant and financially healthy.

This guide explores the top financial pitfalls nonprofits encounter, opportunities for improvement, and how LedgerFi’s nonprofit accounting expertise can help organizations maintain strong financial records.

Common Pitfalls in Nonprofit Accounting

-

Misclassifying Revenue: Restricted vs. Unrestricted Funds

Nonprofits receive income from donors, grants, program fees, and fundraising events. However, failing to properly classify restricted vs. unrestricted funds can lead to compliance issues and misuse of donations.

Key Differences:

- Restricted Funds: Must be used for a specific purpose as designated by the donor or grant provider (e.g., a donor gives $50,000 for an education program).

- Unrestricted Funds: Can be used for any operational or program-related expenses.

Why It Matters:

- Both restricted and unrestricted funds are considered income and must be reported correctly.

- Misclassifying funds can violate donor intent.

Best Practice:

- Use fund accounting to ensure donations are tracked correctly and allocated as required.

-

Incorrect Expense Allocation

Nonprofits must properly allocate expenses among three key categories:

| Expense Category |

Purpose |

| Program Expenses |

Directly support the nonprofit’s mission (e.g., community services, educational programs). |

| Administrative Expenses |

Operational costs (e.g., rent, office supplies, salaries for admin staff). |

| Fundraising Expenses |

Costs related to raising donations (e.g., marketing, fundraising events). |

Why This Matters:

- IRS Form 990 requires nonprofits to report expense breakdowns.

- Misallocating expenses can make a nonprofit appear inefficient or noncompliant, deterring donors and auditors.

Best Practice:

- Maintain clear records of expenses and allocate them to the correct categories before tax season.

-

Poor Tracking Systems & Financial Controls

Common Issues:

- Failing to track in-kind donations: Nonprofits must record donated goods and services at fair market value.

- Grant tracking errors: Some grants require specific spending reports, and failure to comply can result in funding loss.

- Lack of internal controls leading to fraud: Many nonprofits lack financial oversight, making them vulnerable to misuse of funds.

Best Practices for Financial Controls:

- Implement segregation of duties (separate bookkeeping and expense approvals).

- Use accounting software that supports grant tracking and donor reporting.

- Conduct regular internal audits to ensure financial integrity.

Opportunities for Nonprofits to Improve Accounting

- Implementing Fund Accounting for Greater Transparency

Fund accounting ensures that different types of income are tracked separately, providing:

- Accurate financial reporting for donors and grant providers.

- Better budgeting for programs and administrative expenses.

- Compliance with IRS Form 990 requirements.

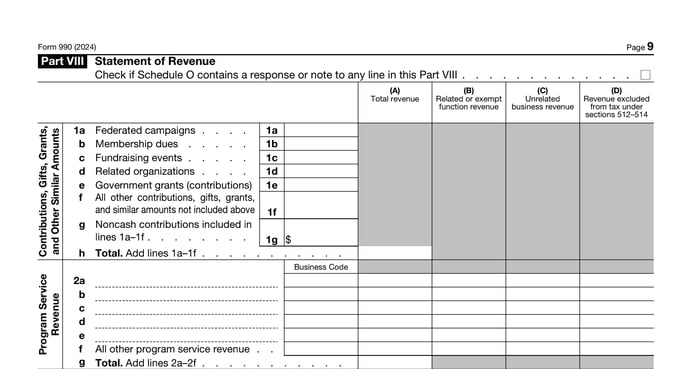

Refer to Form 990 for examples of the different types of income:

Best Practice: Use QuickBooks for Nonprofits and other software to manage funds efficiently.

-

Leveraging Specialized Nonprofit Bookkeeping & Reporting

Nonprofits require custom financial reporting to track donor contributions, grants, and expenses.

LedgerFi’s Nonprofit-Specific Reports Include:

- Top Donors & Donation Trends: Identify recurring donors and optimize fundraising strategies.

- Program Expense Breakdown: Ensure funds are being allocated correctly.

Why This Matters:

- Better financial transparency improves trust with donors, board members, and regulatory agencies.

- Nonprofits that provide detailed financial reports are more likely to secure funding and grants.

-

Understanding Tax-Exempt Benefits & Compliance

501(c)(3) nonprofits are exempt from federal income taxes, but they must maintain compliance to keep their tax-exempt status.

Key Compliance Areas:

✅ Annual IRS Form 990 filing (required for most nonprofits).

✅ State-specific tax exemptions (property tax, sales tax).

✅ Limitations on political activities (501(c)(3) organizations cannot engage in partisan politics).

What Happens If Compliance Is Lost?

- The nonprofit may have to pay federal and state taxes.

- It may lose its ability to accept tax-deductible donations.

- The IRS can revoke 501(c)(3) status for repeated violations.

Best Practice: Work with a nonprofit accountant to ensure IRS compliance and maintain tax-exempt benefits.

-

Maximize Efficiency with Detailed Nonprofit Reporting

How LedgerFi Helps Nonprofits Stay on Track:

✅ Custom reporting to track donations, grants, and expenses.

✅ Specialized bookkeeping for 501(c)(3) compliance.

✅ Expert guidance on fund accounting.

Need nonprofit bookkeeping help? LedgerFi specializes in accounting for 501(c)(3) organizations. Contact us today for expert financial management!

Bottom Line: Why Nonprofit Accounting Matters

Key Takeaways:

- Properly classify income sources to maintain compliance.

- Accurately allocate program, admin, and fundraising expenses on IRS Form 990.

- Implement strong financial controls to prevent fraud and fund misuse.

- Leverage specialized nonprofit bookkeeping to maintain tax-exempt status and donor trust.

- Detailed financial reporting improves donor confidence and helps secure funding.

At LedgerFi, we offer expert nonprofit accounting services to help organizations maintain compliance, track funds, and optimize reporting.

Contact LedgerFi today for a free consultation and ensure your nonprofit’s financial success!