TL; DR

Meaning: A CP259 notice from the IRS means they believe your business was required to file a tax return, and they haven’t received it. It’s not a penalty notice—yet. But it’s a warning, and if you don’t respond, it can lead to serious consequences, including Failure to File penalties.

Next Steps: Review your previous return against the CP259. This will help you tailor your response and documentation accordingly.

What to Do: Once you receive your CP259, you have three options: file the required return, resubmit your already submitted return, or submit a response form explaining why you don’t need to file

What Is a CP259?

The CP259 is a non-filing notice the IRS sends to businesses when they believe you were required to file a return for a certain tax period, but they didn’t receive it.

It's commonly related to:

- Employment taxes (Form 941, Form 940)

- Corporate income taxes (Form 1120)

- Excise taxes (Form 720)

Translation: The IRS thinks your business skipped a required tax return.

Why Did You Get a CP259 Notice?

There are several common reasons why the IRS might issue this notice:

-

You didn’t file a return they expected

You may have missed filing a payroll return (like a quarterly Form 941) or your annual Form 1120. If the IRS was expecting it and didn’t get it, you’ll get a CP259.

-

You filed late, and the return wasn’t processed yet

Sometimes businesses file close to or after the deadline, but the IRS runs its non-filer check before your return is processed.

-

You stopped operating but didn’t tell the IRS

If you closed your business, but didn’t file a final return or mark the return as "final," the IRS will continue to expect future filings.

What to Do When You Receive a CP259 Notice

Don’t ignore it. A CP259 isn’t a penalty yet, but it can quickly become one. Here’s what you should do:

-

Review the notice carefully.

○ It will list the tax form and period the IRS expected but didn’t receive.

2. Determine if you actually needed to file.

○ If you did, file the return ASAP.

○ If you already filed it, check that it was accepted and resubmit it if needed.

○ If you didn’t need to file, there’s usually a response form or box to check stating that.

-

Mail or fax your response to the address or fax number listed on the notice.

-

Work with your tax professional to confirm compliance and ensure you’re up to date.

Failure to File Penalty

If you ignore the CP259, and the IRS determines you were required to file, they may:

● Assess a Failure to File Penalty (usually 5% of the unpaid tax per month, up to 25%).

● File a substitute return on your behalf, often without deductions or credits.

● Begin collection actions.

Responding quickly can help avoid penalties.

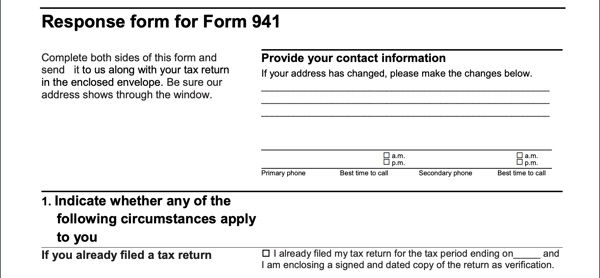

Understanding the CP259 Notice (Page-by-Page Breakdown)

Page 1: Summary of the Issue

- Lists the form(s) and tax period(s) the IRS expected.

- Includes basic contact info and a response deadline.

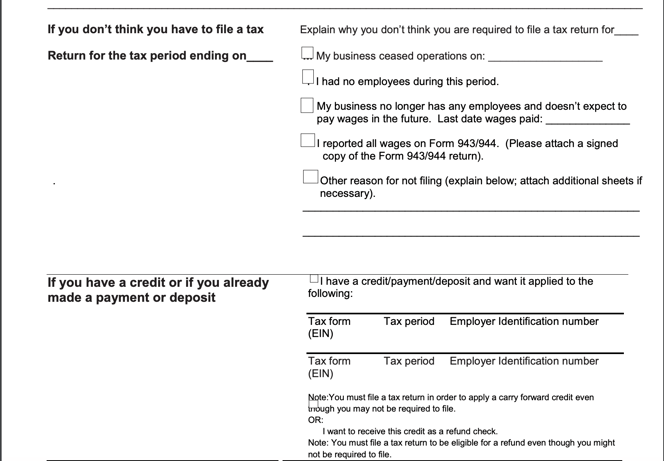

Page 2: Response Options

- Usually a checkbox section where you can indicate:

○ You filed already

○ You are not required to file

○ You’ll file soon

- Includes mailing instructions and a space for a signature.

Page 3+: Explanation and Next Steps

- May include a reminder of penalties for failure to file.

- Provides more detail on how to respond or get assistance.

Summary

A CP259 notice is a heads-up from the IRS that your business may have missed a required tax filing. It’s not a bill or penalty—yet—but it’s a clear sign that you need to take action.

- File the return or explain why you don’t need to.

- Respond by the deadline listed.

- Avoid future notices or penalties by staying on top of filing obligations.

Need help sorting it out? LedgerFi can help you respond to IRS notices, clean up missed filings, and stay compliant year-round. Reach out to our team for expert bookkeeping and tax support.