TL; DR

Meaning: The CP171 is a reminder that you have outstanding taxes owed, including penalties and interest. It's not a new tax bill, it's a notification about an existing balance.

Next Steps: Review your tax records against the CP171 to understand the specific adjustments or errors you disagree with. This will help you tailor your response and documentation accordingly.

What to Do: Once you receive your CP171, you have three options: pay your balance in full, set up a payment plan, or dispute the notice.

Notice of Amount You Owe in Tax, Penalty, and Interest

With the exception of a well-timed tax refund, most of us don't want to receive any kind of correspondence from the IRS. Notices and letters can be confusing - and downright scary - if you don't understand what they are. However, these notices are an important way to ensure that you are compliant with tax laws and avoid penalties. Let’s take a closer look at what a Notice CP171 means.

What Does a CP171 mean?

The notice informs you of the amount you owe in unpaid taxes, penalties (for late filing or payment), and interest (on the unpaid amount) that has accrued over time. While not an immediate crisis, it's important to address the outstanding balance. The IRS will continue to accrue interest on the owed amount until it's paid in full, which can lead to a huge bill. That's why it's so important to deal with the situation that led to the CP171 notice being issued.

Common Reasons for Receiving a CP171

The CP171 notice itself won't tell you the specific reason for your outstanding balance. However, it will detail the amount owed and how to make a payment. Here are some of the most common reasons for receiving a CP171:

Unpaid Tax Balance

This is the most common scenario for a CP171 notice. You simply might have forgotten to pay the remaining balance due after ling your tax return. In some instances, if too little tax was withheld from your paycheck throughout the year, you'll owe the difference when you file. This can happen if you improperly complete your W-4.

Unexpected Taxable Income/Missed Forms

Did you have any unexpected income you didn't report on a W-2 or 1099 form? This could be freelance work, contracts, or even winning the lottery. In the same way, if you forgot to include a Schedule C for self-employment income, you may still owe taxes.

Late Filing Penalty

If you filed your tax return late, there may be a penalty in addition to the tax owed.

Math Error

Math mistakes happen, and the IRS catches them during processing. Miscalculations in income, deductions, or credits could lead to an underpayment. A simple typo when entering a number could throw everything off.

Incomplete Tax Return

Forgetting to attach receipts or documents substantiating deductions or credits, leaving sections of your tax form blank, or incomplete Social Security numbers for yourself or your dependents means that your tax return can’t be completed, leading to a CP171.

Estimated Tax Payment Shortfall

Estimated taxes are quarterly payments made throughout the year to avoid a large tax bill at filing time. If you underestimated your final tax liability, your estimated payments won't cover the full amount owed. In the same way, simply forgetting to make a quarterly estimated tax payment will result in a shortfall.

Understanding the CP171

Page 1: CP171 Notice Overview

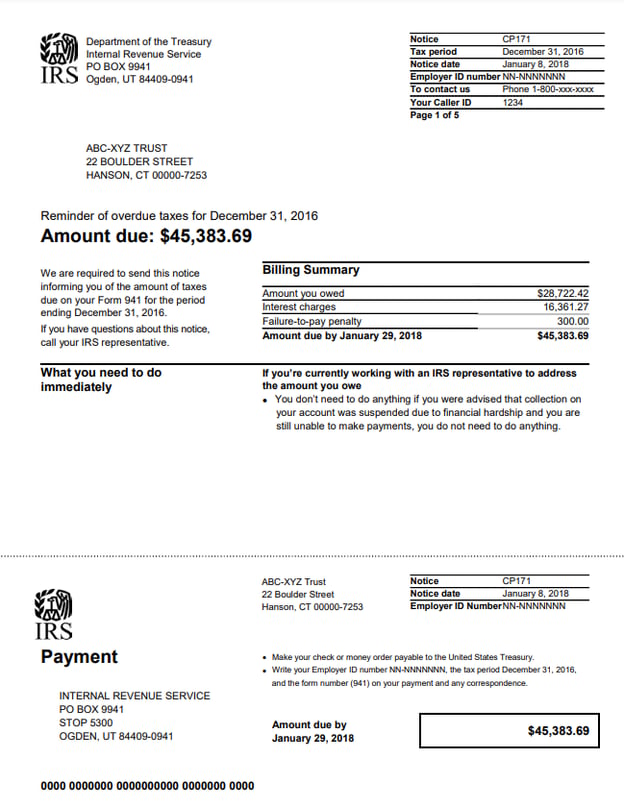

Header: This section prominently displays the IRS logo, the title "Notice CP171" along with the tax year in question. Your taxpayer identification number and the notice date will also be located here.

Why We're Writing to You: This section informs you that you have outstanding tax debt. It will detail the total amount owed, which includes the original tax liability, any late filing penalties, and interest accrued on the unpaid balance.

What You Need to Do Immediately: The IRS provides clear next steps. They will typically instruct you to "Review your tax records" and most importantly, "Pay the amount due in full." The notice will also likely include payment options and deadlines.

What We're Proposing: This section outlines the potential consequences of inaction. It will detail any additional penalties and interest charges that may accrue if you fail to pay the outstanding balance by a specific deadline. The IRS may also mention the possibility of enforced collection actions, such as wage garnishment or liens placed on your property.

How to Make a Payment: This section provides clear instructions on various ways to settle your tax debt. It might include options such as:

- Online payment through the IRS website

- Mailing a check or money order

- Setting up a payment plan

Page 2: Additional Information

This page delves deeper into understanding your outstanding tax debt and your options for resolving it. Here, you'll find details like:

- Breakdown of Charges: This section may provide a more detailed breakdown of the outstanding balance, separating the original tax owed from any penalties and interest charges.

- Payment Options: Here, the IRS might offer additional information on available payment plans, including eligibility requirements and how to set one up.

- Contact Information: This section provides contact information for the IRS if you have any questions or require further assistance.

Page 3: Understanding the Reason for the Debt (Optional)

While not always included, some CP171 notices may dedicate a page to explain the potential reason for the outstanding tax debt. This might include:

- Unpaid Tax Balance: The IRS might reiterate that you simply haven't paid the remaining balance due after filing your tax return.

- Math Error: The notice could acknowledge a potential error on your tax return that resulted in an underpayment.

- Missing Information: This section might mention the possibility of missing information on your return that prevented the IRS from accurately assessing your tax liability.

- Estimated Tax Payment Shortfall: The IRS could explain that your estimated tax payments throughout the year fell short of your final tax liability.

It's important to note that the CP171 notice itself won't pinpoint the exact reason for the outstanding balance. If you suspect an error or have questions, you'll likely need to review your tax return or consult with a tax professional for further clarification.

Page 4: Your Rights as a Taxpayer

The final page of the CP171 notice reminds you of your rights as a taxpayer. It will typically list resources for obtaining additional help from the IRS, should you have any questions or require assistance resolving your tax debt. The notice might also include information on appealing penalties or requesting an abatement (reduction or elimination) of penalties if you have reasonable cause.

In Summary

Being faced with a notice from the IRS is daunting, but it’s important not to ignore it. If you're faced with a CP171 that you want to settle or dispute, and you're unfamiliar with tax laws or procedures, consider getting in touch with a tax specialist. They can guide you through the dispute process or payment options and ensure you're taking the necessary steps to resolve the issue effectively.

You can always get in touch with one of the experts at LedgerFi if you need a helping hand.