TL;DR

What it means: The IRS has reduced or removed a previously assessed estimated tax penalty (often from a prior CP30 notice).

Why you got it: The IRS accepted a correction, payment, or form—like Form 2210—or applied a penalty waiver.

What to do: Review the notice, compare it to the original CP30 (if applicable), check your updated tax balance, and contact a tax professional if you have questions.

What Is a CP30A?

A CP30A is an IRS notice indicating that a previously assessed estimated tax penalty has been reduced or removed. It often follows an earlier CP30 notice, which informed you that you owed a penalty for underpaying estimated taxes.

The CP30A is essentially a correction or update from the IRS—usually in your favor.

Why Did You Get a CP30A?

You might receive a CP30A for several reasons, including:

- The IRS corrected an internal error

- You filed and the IRS accepted Form 2210 (Underpayment of Estimated Tax)

- A penalty waiver you requested was approved

- You made a late payment that was eventually credited

- Additional documentation or payments were received after the CP30 notice was issued In most cases, the CP30A reflects a favorable adjustment.

What to Do When You Receive a CP30A

Here’s what to do next:

- Read the entire notice carefully.

- Compare it with your original CP30 notice (if you received one).

- Log in to your IRS account at IRS.gov to check your updated balance. 4. If you already paid the penalty, monitor for a credit or refund.

- Contact a tax professional if you're unsure about the notice or next steps. No response is typically required unless the IRS requests additional action or payment.

Understanding the CP30A Notice (Page-by-Page Breakdown)

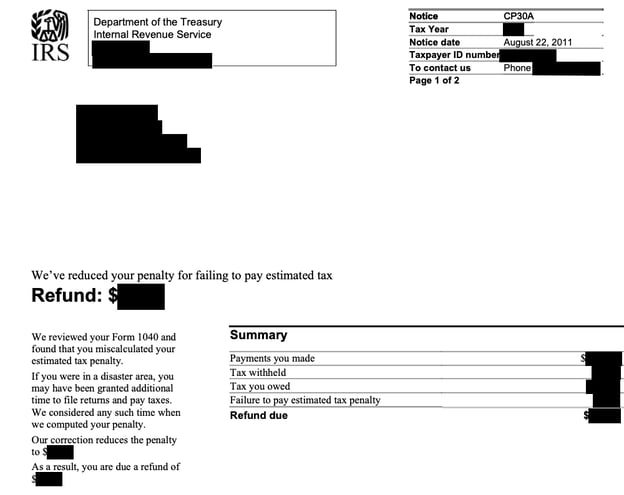

Page 1 – Notice Summary

- Shows your original penalty and the updated (lower or removed) amount

- Reflects your current tax balance

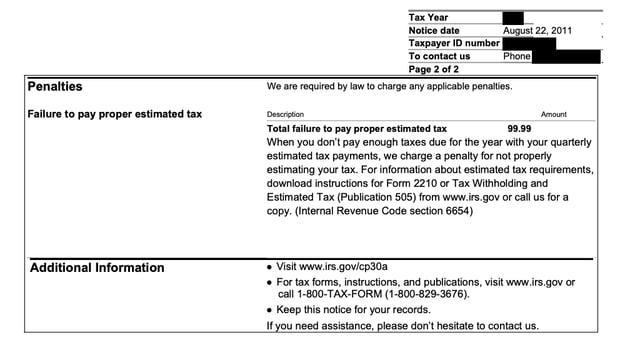

Page 2 – Explanation of Adjustment

- Describes what changed and why

- Notes any forms accepted or payments credited

Page 3 – Payment Instructions (If Applicable)

- If you still owe anything, this page provides payment options

- May also explain how refunds or credits will be applied to your account

Bottom Line

A CP30A notice is usually a positive correction from the IRS. It means you’ve successfully reduced or eliminated your estimated tax penalty—either through payment, documentation, or an accepted waiver.

Need help making sense of the notice or planning your estimated tax strategy? LedgerFi can help you navigate IRS correspondence, minimize penalties, and stay ahead of tax deadlines. Contact us today for expert support.