TL; DR

Meaning: Form 945 is used to report federal income tax withheld from non-payroll payments, such as pensions, gambling winnings, and backup withholding. It's not for wages—those go on Form 941 or 944.

Next Steps: If you're required to file Form 945, gather all necessary withholding information from payments made throughout the year. This includes amounts withheld from pensions, IRAs, gambling winnings, and backup withholding for vendors.

What to Do: Ensure that you file Form 945 by January 31 each year (or February 10 if all taxes were deposited on time). Pay any outstanding withholding tax and ensure compliance to avoid penalties.

What is Form 945?

Form 945 is an annual IRS tax form used to report federal income tax withheld from certain types of non-payroll payments. Unlike Forms 941 or 944, which deal with payroll taxes, Form 945 focuses on withholdings from sources like:

- Pensions and annuities

- Gambling winnings

- Dividends and interest (when subject to backup withholding)

- Certain payments to non-employees that require withholding

If you are a payer who withholds federal income tax from these types of payments, you must file Form 945 once a year to report those withholdings.

Why Did You Receive a Notice About Form 945?

You may have received a notice from the IRS regarding Form 945 because your company either:

- Previously filed Form 945 in a prior tax year, or

- Was expected to file Form 945 for the 2025 tax year based on prior filings.

To resolve this notice, follow these steps:

1. Determine if the Company is Required to File Form 945

- Review the 1099-MISC and/or 1099-NEC forms issued.

- Look at Box 4 (Federal Income Tax Withheld) on these forms.

- If Box 4 is empty on all forms, the company is not required to file Form 945.

- If Box 4 contains amounts, Form 945 must be filed.

2. If Not Required to File Form 945

- Complete pages 3 and 4 of the IRS notice.

- Select the reason: "My business had no activity for the period above."

- Send the response to the IRS:

- Mail it to the address provided on the notice, or

- Fax it to the tax number referenced in the form.

3. If Required to File Form 945

- Prepare and submit Form 945 to the IRS.

Key Deadlines for Form 945

- Filing Deadline: January 31 of the following year.

- Electronic Filing Option: Employers can e-file Form 945 via the IRS FIRE (Filing Information Returns Electronically) System.

- Deposit Schedule:If withholding is $2,500 or less for the year, you can pay with the return.

- If your withholding is over $2,500, you must deposit electronically. You should use the Electronic Federal Tax Payment System (EFTPS) either monthly or biweekly.

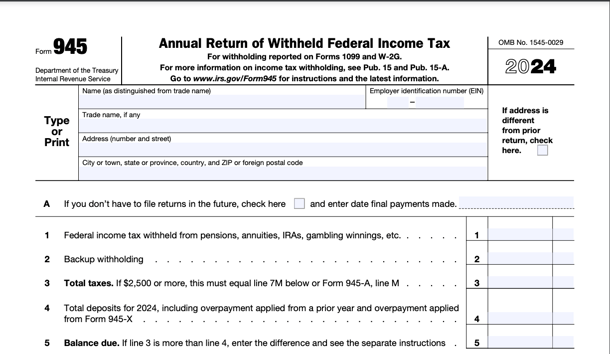

How to Fill Out Form 945

Page 1: Form 945 Overview

- Business Information: Enter your Employer Identification Number (EIN), name, and address.

- Federal Income Tax Withheld: Total tax withheld from non-payroll payments during the year.

- Deposit Schedule & Tax Liability: Check the appropriate box for deposit frequency (monthly/semiweekly).

Page 2: Payment & Reconciliation

- Total Deposits for the Year: Compare total deposits to the tax withheld.

- Balance Due or Overpayment: If an overpayment exists, choose whether to apply it to next year or request a refund.

Common Errors & How to Avoid Them

Mixing payroll and non-payroll tax reporting: Do not report payroll withholdings on Form 945. Use Form 941 or 944 for payroll taxes.

Forgetting to deposit withheld amounts on time: The IRS imposes penalties for late deposits or failure to deposit through EFTPS.

Failing to report backup withholding: If you've issued Form 1099-NEC or 1099-MISC to a vendor but didn't receive a valid TIN, backup withholding applies—and must be reported on Form 945.

What Happens If You Don’t File Form 945?

❌ Failure to file: The IRS may assess failure-to-file penalties, which start at 5% of the unpaid tax per month (up to 25%).

❌ Late payment penalties: If payments are late, penalties range from 2% to 15%, depending on how late they are.

❌ Interest accrues: The IRS adds interest daily to unpaid tax amounts.

To avoid these issues, file Form 945 on time and ensure all deposits are properly made.

Bottom Line

Form 945 is an important IRS tax form. Used to report federal income tax taken from non-payroll payments, this tax includes pensions, gambling winnings, and backup withholding. Filing it correctly and on time ensures compliance and prevents penalties.

If you received an IRS notice about Form 945, first determine if you are required to file based on 1099 forms issued. If not, respond to the IRS with the appropriate notice pages. If filing is required, submit Form 945 before the deadline.

Need help? Our experts at LedgerFi can assist you in navigating withholding requirements and IRS filings. Contact us today!