Receiving an IRS notice can be scary, but it doesn’t have to be. These documents share important information! With some help, you can understand what they mean and know what to do next.

No matter how organized and meticulous you are, dealing with the IRS is simply a part of being in business. The good news is that the more prepared and organized you are, the easier the process will go in the end. A bookkeeper at LedgerFi can help you streamline your financial matters and keep your financial matters organized.

Step 1: Locate the Notice Number & Verify Your Details

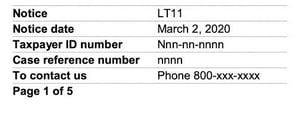

At the very top of the notice, you’ll see a unique identifier known as the “notice number.” You usually find it in the upper-right corner but it can also be found at the bottom right hand corner. The sequence starts with "CP" or "LTR" and follows with numbers, like CP14 or LTR3219. The good thing about the IRS is that they are a government agency and therefore need to identify each form/notice they send. This form identification number tells you why the IRS is contacting you.

Common Notice Examples:

- CP14: Balance Due.

- CP503: Second Reminder for Unpaid Taxes.

- LTR12C: Request for additional information.

Remember this number! It is important when referring to the notice when you contact the IRS agent or talk to your bookkeeper. Identifying the number also makes it easier to research, especially with the help of our fantastic IRS library.

Directly below or next to the notice number, you’ll find the IRS’s record of your name, address, and taxpayer identification number (TIN). Confirm that this information matches your records. Errors here could indicate a misdirected notice or a need for immediate correction.

The notice will specify the tax year or period it pertains to. This detail is crucial for understanding what portion of your tax filings is under review.

Looking up the form that you filed during this period will also give you an idea as to what went wrong and what the situation is about. Is it payroll? Employer Taxes? Income Tax? Ultimately, the form number should tell you what type of tax is being discussed. Also look for phrases like "For tax year ending December 31, [year]." Quarterly tax forms like payroll tax will mention the specific quarter. These will help you, and your bookkeeper, focus your review on the right records.

Step 2: Review the Notice & Analyze the Amounts

Next, the notice will outline why the IRS is contacting you. This section might include:

- Balance Due: Amounts you owe and a breakdown of how they were calculated.

- Proposed Changes: Adjustments made to your return, often due to discrepancies.

- Request for Information: Documents or clarifications needed to complete processing.

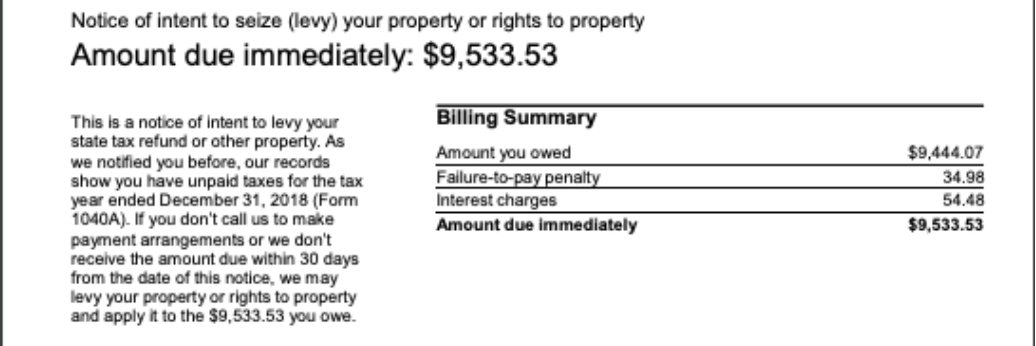

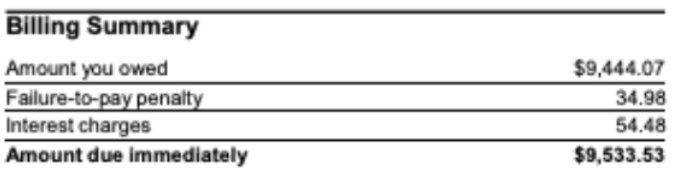

Read this section carefully to understand the action the IRS expects from you. The notice will detail any amounts you owe, overpayments, or adjustments. It’s typically presented as:

- Original amount.

- Adjustments made (e.g., penalties, interest, or credits).

- Total amount due or refund owed.

You will see in bigger letters at the top there will be a big number but the billing summary is where you can better understand how that number has been broken down. Compare these figures with your records to identify discrepancies.

IRS notices will include specific instructions on what you need to do next. This might involve:

- Paying a Balance: Where and how to make the payment.

- Disputing a Notice: Steps to request a review or appeal.

- Providing Documents: A list of forms or evidence to submit.

Follow these instructions carefully to ensure compliance and avoid unnecessary penalties. And when it comes to big balances always contact a tax professional you may qualify for specific programs etc.

Step 3: Track Deadlines & Review Contact Details

IRS notices often come with deadlines for responses or payments. These are non-negotiable, so make a note of the dates and act promptly. If you miss a deadline the irs could take action depending on your tax issue that could mean anything from a lien to a levy.

At the bottom or in the margins of the notice, you’ll find contact details for the IRS office handling your case. It may include:

- A toll-free phone number.

- Office hours for inquiries.

- Mailing addresses for responses or payments.

Having this information handy can streamline your communications with the IRS. I would also recommend looking for a specific person and their contact information to avoid waiting on hold for hours.

What to Do If You’re Unsure

If you’re uncertain about how to interpret the notice or how to proceed, don’t panic. Here are some immediate steps:

- Contact a Professional: Bookkeepers and tax professionals can help review the notice and recommend actions.

- Keep Records: Store the notice with your tax documents for reference.

- Respond Promptly: Even if you dispute the notice, timely communication shows good faith and prevents escalations.

Handling IRS notices doesn’t have to be overwhelming. By breaking them down step by step, you can gain clarity and take the right actions. At LedgerFi, we’re here to help you stay on top of your tax responsibilities and keep your financial records in order.

Need help decoding an IRS notice? Check out our IRS library or Contact us today —we’re here to simplify your bookkeeping and tax management!